by Paul Donnelly

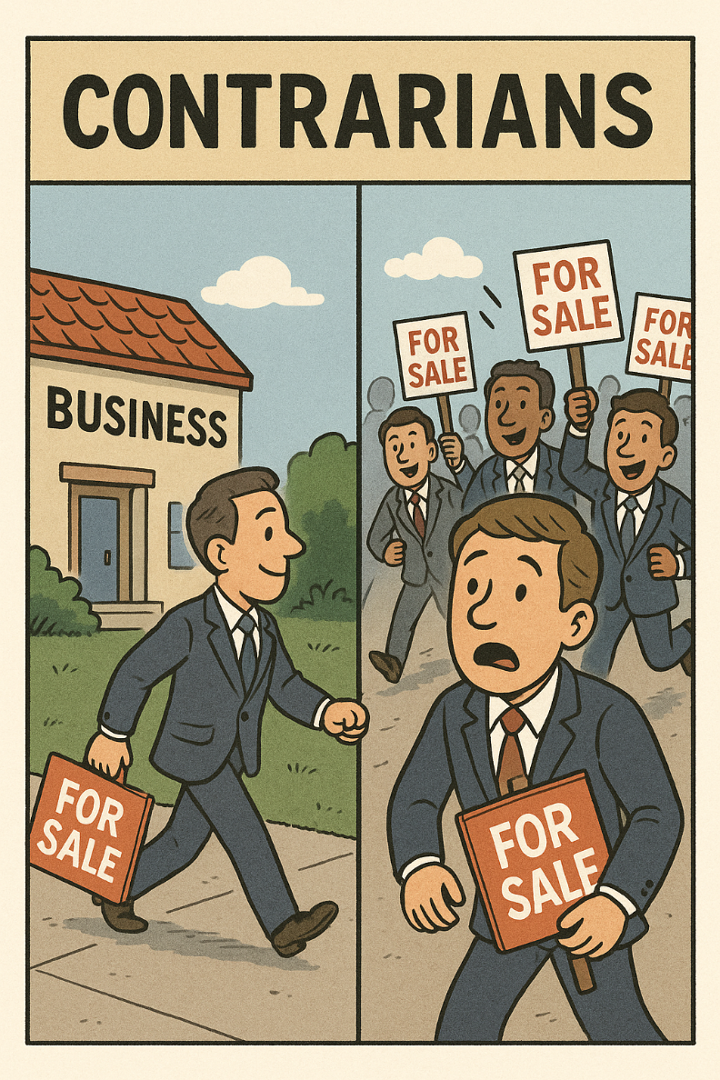

In M&A, timing is everything. Many business owners are waiting on the sidelines, uncertain about the economy, interest rates, and tariffs. But when confidence returns, they’ll all rush to market at the same time. That means a flurry of deals, crowded buyer attention, and downward pressure on valuations.

The contrarian approach? Get ready now.

While others wait, you stand out. Buyers are actively looking, and fewer quality companies are available — which gives your business more visibility and leverage.

Preparation takes time. Positioning your financials, operations, and growth story now means you’re ready when the right buyer appears.

Today’s uncertainty is tomorrow’s opportunity. Strategic and private equity buyers have capital to deploy and are willing to pay premiums for businesses that offer stability and resilience.

Don’t let your exit compete with dozens of others when the market floods. Be a contrarian: start preparing your business today and capture buyer interest while the field is less crowded.

The best deals go to those who act, not those who wait.

What if my Company is too small to be a Private Equity Platform investment?

If your company is too small to be a private equity (PE) platform investment (under $5M in EBITDA), you may still be highly attractive as an add-on acquisition or to strategic buyers.

The “best time” to sell depends on a few key factors:

1. When Your Industry Is in Consolidation Mode

PE firms often buy smaller companies to “bolt on” to an existing platform.

If your sector is in a wave of consolidation, buyers are motivated to acquire strong add-ons quickly.

Selling during this phase often means higher multiples, since buyers are paying for synergies and speed to scale.

2. When You’ve Hit a Natural Growth Plateau

If your business has grown steadily but now needs significant capital, technology, or distribution channels to reach the next level, that’s a signal.

Buyers see more value if you’ve proven your model but haven’t yet saturated the market — they want to capture that upside.

3. When Market Conditions Favor Add-Ons

In high-interest-rate environments, PE firms may slow down platform deals (which require more leverage), but add-ons are still active because they can be smaller, faster transactions with immediate synergies.

That makes now an attractive window if you’re too small to be a standalone platform.

4. When Your Financials Are Trending Upward

Buyers pay more for momentum. Selling right after a few strong years — even if you’re small — signals stability and growth potential.

Waiting until results flatten or dip can reduce competitive tension in a sale process.

5. When You’re Not Competing With a Flood of Sellers

Just like we discussed with being contrarian, the best time to sell is often before the market becomes crowded with similar deals.

If you’re not a platform, standing out is even more important.

In short: The best time to sell is when your industry is consolidating, your business has momentum, and buyer competition is high — not when everyone else is rushing to market.

Coil partners Deal Experience

Paul Donnelly and the Coil Partners team have executed over 140 transactions through all stages of market and economic volatility. We specialize in delivering corporate finance advisory and investment banking services to emerging growth and middle market firms. Thanks to our extensive industry experience, we have the expertise to close the most complex of deals. Over the years, Paul and the Coil Partners team have completed over $4.85 billion in transaction values.